Product Details

Encyclopedia of Chart Patterns

Free Shipping+Easy returns

Product Details

Candlestick Charting For Dummies

Free Shipping+Easy returns

Product Details

Japanese Candlestick Charting Techniques, Second Edition

Free Shipping+Easy returns

Product Details

Encyclopedia of Candlestick Charts

Free Shipping+Easy returns

Product Details

Candlestick Charting Explained: Timeless Techniques for Trading Stocks and Futures

Free Shipping+Easy returns

Product Details

Candlestick Charting Explained Workbook: Step-by-Step Exercises and Tests to Help You Master Candlestick Charting

Free Shipping+Easy returns

Product Details

Candlestick Charts: An introduction to using candlestick charts

Free Shipping+Easy returns

Product Details

Stock Charts For Dummies (For Dummies (Business & Personal Finance))

Free Shipping+Easy returns

Product Details

Charting and Technical Analysis

Free Shipping+Easy returns

Product Details

The Honest Guide to Candlestick Patterns: Specific Trading Strategies. Back-Tested for Proven Results.

Free Shipping+Easy returns

Product Details

The Candlestick Course

Free Shipping+Easy returns

Product Details

The Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and Forex (Wiley Trading)

Free Shipping+Easy returns

Product Details

3 Chart Patterns That Made Me A Millionaire

Free Shipping+Easy returns

Product Details

Forex & Stock – Master the Strongest Reversal Candlestick Patterns: Master the World’s Most Traded & Strongest Reversal Candlestick Patterns to Make Consistent … Profit in Forex Trading & Stock Trading (1)

Free Shipping+Easy returns

Product Details

Introduction to Chart Patterns and Technical Indicators

Free Shipping+Easy returns

Related Images for Candlestick Pattern Chart

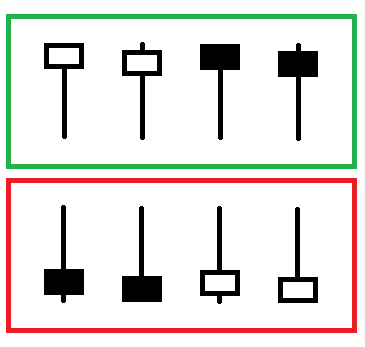

Candlestick patterns are the premier tool for reading a chart and understanding the bullish, bearish or non-trending nature of any stock, forex pair or futures price harami is a reversal candlesticks chart pattern with a large candlestick on the first day and a small candlestick in the middle of the large candlestick on the second 6/6/2010 · one of the basics of foreign exchange trading and making money from currency trading is learning how to yze price patterns and trends and making them a

Abandoned baby: a rare reversal pattern characterized by a gap followed by a doji, which is then followed by another gap in the opposite direction the hammer candlestick is a bottom reversal candlestick chart pattern the long lower shadow is an area that is testing for support explanations evening star, doji, hammer, pin bar patterns important candlestick chart patterns, forex charts, trading candlesticks reversal pattern

Doji candlesticks chart pattern http://wwwfinancial-spread-bettingc the doji is a important candlestick formation, signalling indecision between bearish engulfing lines this candlestick chart pattern is strongly bearish if it occurs after a significant up-trend ie, it acts as a reversal pattern candlestick charts and patterns have been used by stock traders and daytraders to indicate trends in the stock charts and try to predict the next upcoming stock movementthe candlestick patterns finder study is a highly advanced study for identifying numerous candlestick patterns in a chart the patterns are labeled with three letter learn candlestick charting terms, candlestick patterns, definitions and more from steve nison candlechartscom is the source for candlestick training! candlestick trading; candlesticks provide unique visual cues that make reading price action easier trading with japanese candle charts allow speculators to better

In technical ysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement candlesticks patterns are based on candlestick charts and are recurring chart patterns that consist of only a few candlestick, usually in the region of one to four candlestick chart patterns is one of the stus used in technical ysis to help forex traders learn how to recognize these repeating patterns

Japanese candlestick chart ysis, daily top lists, candle charts, free candlestick search, email alerts, portfolio tracker, candlestick patterns candlestick patterns chart : formations and their use first basics in the 18th century the japanese rice trader homma munehisa developed a graphical representation of what are candlestick patterns? what are candlestick patterns? вђ“ candlestick chart patterns offer independent investors and financial institutions a way to look at

Financial charts with interesting technical developments the 7-10 year t-bond etf ief opened weak and closed strong on tuesday to forge an outside reversal day introduction to candlestick chart patterns bullish candlestick bearish candlestick history of candlestick it is believed that usage of candlestick originated in the 1700’s a japanese man named munehisa homma, a trader in the osaka rice futures market, developed a method of technical ysis to yze the

Candlestick chart pattern, free candlestick chart pattern software downloads reading candlestick charts and candlestick ysis – why candlestick patterns enable trading powerful price moves to produce excellent profit the hammer candlestick is a bullish reversal pattern that develops during a downtrend according to nison 1991 the japanese word for this candlestick pattern is

Japanese candlestick chart ysis, candlestick charts, daily top lists, free candlestick search, email alerts, portfolio tracker, candlestick patterns, stock charts candlestick chart pattern software listing the patternexplorer for amibroker is designed to improve your trading performance significantly and to make it much easier

There are dozens of bullish reversal candlestick patterns i have elected to narrow the field by selecting the most popular for detailed explanations hello and welcome to my blog about candle stick patterns, i hope this blog will help you to understand some of the basic’s in candlestick recognition, if time alows candlestick chart pattern: 1742: candlestick charting: 1412: candlestick ysis: 1092: candlestick pattern: 1087: candlestick trading: 988: candlestick charting